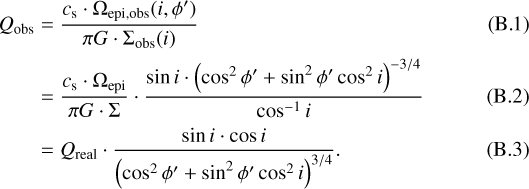

In recent times, the enchantment of investing in gold has surged, notably among individuals in search of a technique to diversify their retirement portfolios. A Gold Particular person Retirement Account (IRA) allows investors to carry physical gold and different treasured metals as part of their retirement financial savings. When you have almost any issues concerning wherever along with how to employ metro-estates.ch, you can call us with our own web page. This report goals to supply a complete overview of what a Gold IRA is, the advantages of investing in gold, the strategy of establishing a Gold IRA, and essential issues for potential buyers.

What's a Gold IRA?

A Gold IRA is a sort of self-directed Individual Retirement Account that allows traders to include bodily gold bullion, coins, and different precious metals in their retirement portfolio. Not like conventional IRAs, which usually hold paper belongings resembling stocks and bonds, a Gold IRA offers the opportunity to put money into tangible belongings which have traditionally been thought of a safe haven during financial uncertainty.

Benefits of Investing in a Gold IRA

- Hedge In opposition to Inflation: Gold has lengthy been seen as a hedge towards inflation. When the value of paper forex declines, gold typically retains its value, making it a dependable retailer of wealth. By including gold in an IRA, investors can protect their retirement savings from the eroding effects of inflation.

- Portfolio Diversification: Gold can present diversification in a retirement portfolio. By including gold to a mix of assets, buyers can reduce overall risk. Gold often behaves in a different way than stocks and bonds, and its worth might rise when different investments decline, thereby balancing out potential losses.

- Tangible Asset: Not like stocks or bonds, gold is a physical asset that can be held and stored. This tangibility can provide a way of security for traders who want to have a portion of their wealth in a form they can bodily entry.

- Tax Advantages: Similar to conventional IRAs, Gold IRAs supply tax-deferred development. Because of this investors don't pay taxes on the positive aspects from their gold investments until they withdraw funds from the account, usually throughout retirement once they could also be in a decrease tax bracket.

- Safety from Financial Uncertainty: Gold has traditionally been seen as a protected-haven asset throughout times of economic downturns, geopolitical tensions, and market volatility. Investing in gold can present a sense of stability in uncertain instances.

The way to Set up a Gold IRA

Organising a Gold IRA includes a number of steps, and it is essential to follow the correct procedures to make sure compliance with IRS regulations.

- Choose a Custodian: The first step in setting up a Gold affordable gold-backed ira investment accounts is to pick a custodian. The IRS requires that every one IRAs, together with Gold IRAs, be held by a professional custodian, which is usually a financial institution, credit union, or specialised IRA company. It's essential to decide on a custodian with experience in handling treasured metals and a good popularity.

- Open the Account: As soon as a custodian is chosen, the investor should full the required paperwork to open a self-directed Gold IRA. This may occasionally contain providing personal information, financial details, and choosing the type of account (conventional or Roth).

- Fund the IRA: Buyers can fund their Gold IRA by means of numerous strategies, including transferring funds from an existing retirement account (akin to a 401(k) or conventional IRA) or making a new cash contribution. It is very important adhere to IRS contribution limits and rules.

- Select and purchase Gold: After funding the account, the investor can select the sorts of gold they wish to buy. The IRS has specific guidelines relating to the varieties of gold that can be held in a Gold IRA. Acceptable forms embrace gold bullion, coins, and sure kinds of gold bars that meet minimum purity requirements (sometimes 99.5% pure).

- Storage of Gold: The physical gold ira investment firm rankings bought for the IRA should be stored in an approved depository. Investors cannot take possession of the gold themselves, as this might violate IRS rules. The custodian will arrange recommended firms for investing in precious metals the gold to be securely stored in a facility that meets IRS standards.

- Monitor and Manage the Investment: Once the Gold IRA is established and funded, investors should actively monitor their investments. This includes staying informed about market developments, gold costs, and any adjustments in IRS rules that will affect their funding.

Necessary Issues

Whereas investing in a Gold IRA has several advantages, there are necessary components to consider earlier than proceeding:

- Fees and Costs: Organising and sustaining a Gold IRA can involve varied fees, including custodian fees, storage charges, and transaction prices. Investors should completely research and understand these costs earlier than committing.

- Market Volatility: Although gold is commonly seen as a secure gold-backed retirement accounts-haven asset, its value can still be unstable. Buyers needs to be prepared for fluctuations in gold costs and understand that past efficiency doesn't guarantee future results.

- IRS Laws: It is essential to adjust to IRS rules regarding Gold IRAs. Failure to adhere to those regulations may end up in penalties, taxes, and disqualification of the IRA. Investors ought to work with knowledgeable custodians and financial advisors to ensure compliance.

- Lengthy-Time period Funding: Gold needs to be considered as a long-time period funding. Whereas it might probably provide safety against inflation and economic uncertainty, it could not yield excessive returns in the brief time period. Traders should have a clear strategy and timeline for their investment.

- Funding Strategy: Earlier than investing in a Gold IRA, individuals should consider their total funding technique and how gold fits into their retirement targets. It is essential to evaluate danger tolerance, funding horizon, and monetary targets.

Conclusion

Investing in a Gold IRA generally is a valuable addition to a retirement portfolio, offering benefits comparable to inflation safety, diversification, and a tangible asset to hold. Nevertheless, potential investors should fastidiously consider the process, prices, and regulatory requirements related to establishing a Gold IRA. By doing thorough research and dealing with knowledgeable professionals, individuals can make informed choices that align with their retirement goals and monetary methods. As the financial panorama continues to evolve, the allure of gold as a protected haven remains strong, making Gold IRAs an appealing possibility for many buyers.