As economic uncertainty looms and inflation charges rise, many traders are turning to gold as a safe haven for his or her belongings. One of the simplest methods to spend money on gold is thru a Gold Individual Retirement Account (IRA). A Gold IRA permits people to hold physical gold and other valuable metals in a tax-advantaged retirement account, providing both security and potential growth. In this text, we'll discover the best Gold IRA choices for 2023, highlighting their options, advantages, and what to contemplate when choosing the proper provider.

Understanding Gold IRAs

A Gold IRA is a specialised retirement account that allows you to invest in bodily gold, silver, platinum, and palladium. Unlike conventional IRAs that usually hold stocks, bonds, and mutual funds, a Gold recommended ira providers for gold gives the distinctive benefit of tangible belongings. This can be notably appealing during occasions of financial instability, as gold has historically maintained its worth.

Why Select a Gold IRA?

- Hedge Towards Inflation: Gold has been a trusted options for investing in retirement iras retailer of worth for centuries. When inflation rises and forex values decline, gold usually will increase in worth, making it a reliable hedge.

- Diversification: Adding gold to your funding portfolio can cut back general danger. Gold usually moves inversely to stock markets, providing a buffer throughout market downturns.

- Tax Benefits: Like traditional IRAs, Gold IRAs supply tax-deferred growth. This implies you won’t pay taxes on your earnings until you withdraw funds during retirement.

Key Features to Look for in a Gold IRA Provider

When deciding on a Gold IRA supplier, it is important to think about a number of factors:

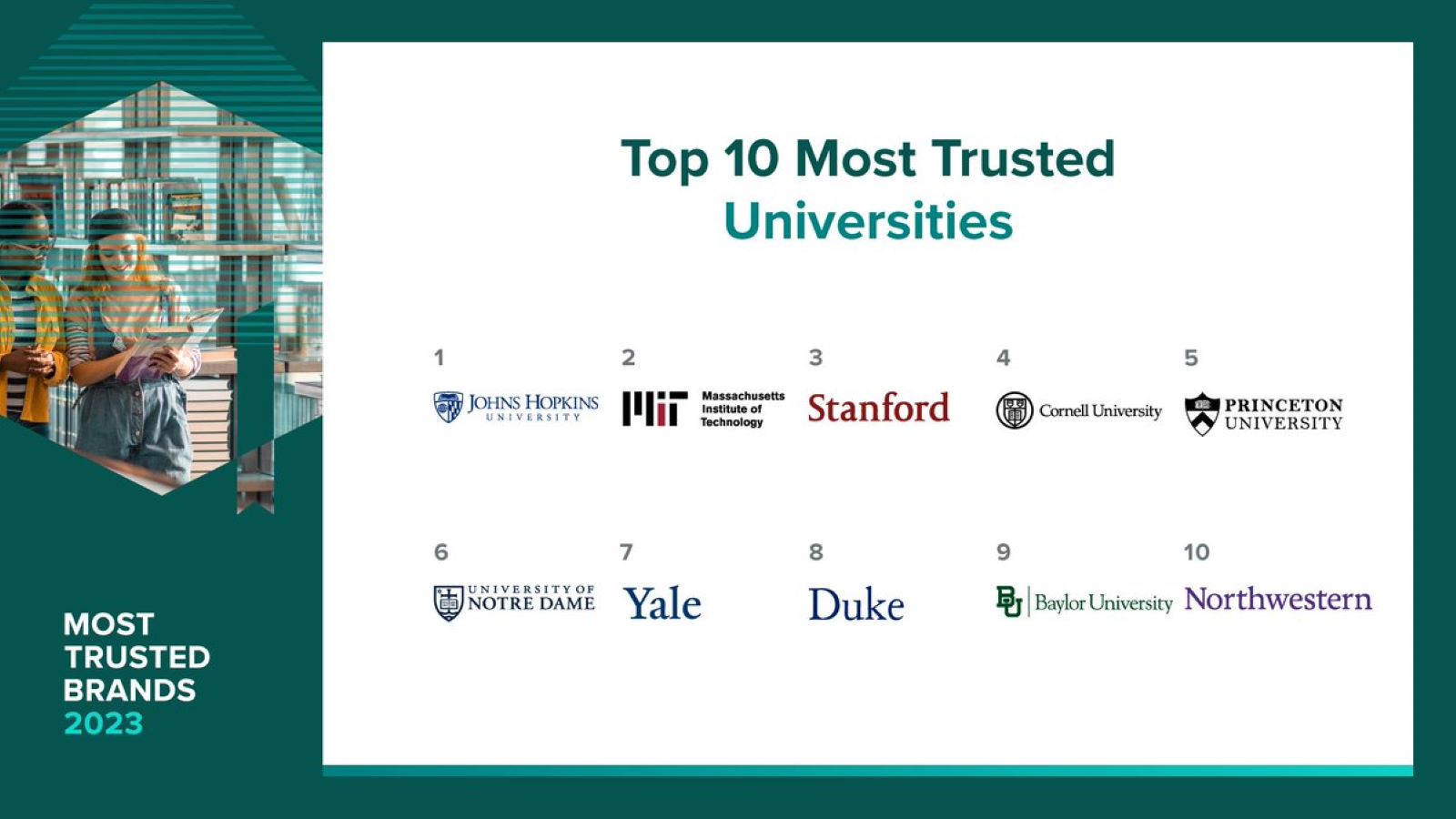

- Fame and Trustworthiness: Analysis the provider's status. Search for reviews, rankings, and any regulatory actions which will have been taken towards them.

- Charges and Prices: Understand the fee structure, including setup charges, storage charges, and another prices related to maintaining the account. Some providers may provide decrease charges however compromise on service quality.

- Customer service: A responsive and knowledgeable customer support crew can make a major difference, especially on the subject of navigating the complexities of a Gold IRA.

- Storage Options: Gold must be saved in an accredited depository. Verify if the provider affords segregated or non-segregated storage and the security measures in place.

- Investment Options: Be sure that the supplier provides a spread of funding options, together with numerous sorts of gold and other treasured metals.

Top Gold IRA Suppliers for 2023

Listed below are a number of the best Gold IRA suppliers for 2023, based mostly on reputation, customer critiques, and total service high quality.

1. Birch Gold Group

Birch Gold Group is a properly-established name in the Gold IRA industry. They offer a wide range of treasured metals, together with gold, silver, platinum, and palladium. Birch Gold is understood for its excellent customer service and instructional assets, serving to investors understand the benefits of gold investing. They also supply a seamless setup course of and aggressive charges.

2. Noble Gold Investments

Noble Gold Investments has built a strong repute for its transparent pricing and no-pressure sales ways. They provide a variety of gold and silver products for IRA investment and provide a unique function: a free gold funding information for brand new investors. Noble Gold can be identified for its commitment to buyer satisfaction, with a devoted group to assist shoppers throughout the investment course of.

3. Goldco

Goldco is another high contender in the Gold IRA market, specializing in helping purchasers convert their current retirement accounts into Gold IRAs. They have acquired high ratings for his or her customer service and educational assets. If you have any queries relating to wherever and how to use expert advice on gold ira investment, you can call us at our own web site. Goldco affords quite a lot of treasured metals and has a straightforward price construction, making it straightforward for traders to grasp their costs.

4. American Hartford Gold

American Hartford Gold has garnered attention for its dedication to transparency and customer education. They provide a wide selection of gold and silver merchandise and have a user-pleasant webpage that gives beneficial info for investors. Their group of consultants is on the market to guide purchasers through the method, guaranteeing a clean expertise.

5. Regal Assets

Regal Property is understood for its modern strategy to Gold IRAs, providing a range of other belongings alongside precious metals. They have a robust deal with customer service and supply a wealth of academic sources. Regal Belongings also offers a unique buyback program, permitting investors to promote their gold again to the corporate at aggressive costs.

Steps to Open a Gold IRA

Opening a Gold IRA involves several easy steps:

- Choose a Provider: Research and choose a Gold IRA supplier that meets your needs.

- Arrange Your Account: Complete the mandatory paperwork to establish your Gold IRA.

- Fund Your Account: You can fund your Gold IRA through a direct switch from one other retirement account or by making a cash contribution.

- Choose Your Metals: Work along with your supplier to decide on the kinds of gold and different valuable metals you need to invest in.

- Storage: Your gold will have to be stored in an IRS-approved depository. Your supplier will usually assist with this process.

- Monitor Your Funding: Keep a watch in your Gold IRA and make changes as wanted primarily based on market conditions and your retirement targets.

Conclusion

Investing in a Gold IRA can be a smart move in right now's uncertain economic climate. By choosing a good provider and understanding the benefits of gold investing, you'll be able to protect your retirement savings while doubtlessly rising your wealth. As you discover your options, consider the options and services supplied by the top Gold IRA suppliers in 2023. With the suitable strategy, a Gold IRA could be a worthwhile addition to your funding portfolio, providing safety and peace of mind to your financial future.