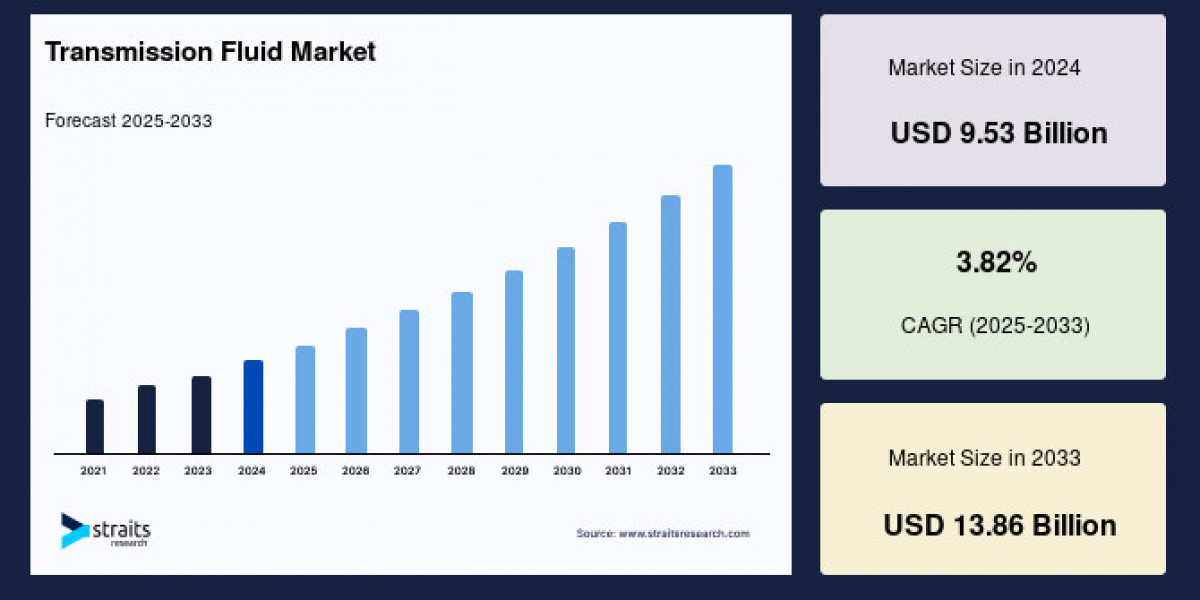

The global transmission fluid market size was valued at USD 9.53 billion in 2024 and is projected to grow from USD 9.90 billion in 2025 to USD 13.86 billion by 2033, exhibiting a CAGR of 3.82% during the forecast period (2025–2033).

Market Dynamics and Growth Drivers

A primary force propelling the transmission fluid market is the expanding automotive sector, especially in emerging economies such as China and India. Rising disposable incomes in these regions are increasing passenger vehicle sales, which in turn boosts demand for transmission fluids. The automotive industry's shift toward automatic transmissions and continuously variable transmissions (CVTs) further intensifies this need, as these systems require specialized fluids to ensure smooth gear shifts and enhanced durability.

Moreover, the demand for high-performance and fuel-efficient vehicles is encouraging manufacturers to innovate transmission fluids that reduce friction and improve energy efficiency. Regulatory pressures worldwide, including strict emissions and fuel economy standards, are driving the adoption of synthetic and eco-friendly fluid formulations. These advanced fluids offer superior thermal stability, longer service life, and compliance with environmental requirements, establishing them as a preferred choice over traditional mineral-based oils.

Technological Advances and Product Trends

Innovations in fluid technology are reshaping the transmission fluid landscape. The market is witnessing increased adoption of synthetic fluids due to their enhanced performance characteristics, such as oxidation resistance and viscosity stability, which are critical for modern transmission systems like dual-clutch transmissions (DCTs) and CVTs. Eco-friendly, bio-based fluids are also gaining traction as the automotive industry aligns with global sustainability goals and decarbonization efforts.

In response to the rise of electric and hybrid vehicles, formulators are developing specialized fluids designed to meet the unique requirements of these powertrains. Electric vehicles (EVs) usually demand fluids with improved dielectric properties and heat management capabilities adapted to their compact, compact transmission systems. However, the growing adoption of EVs presents a restraint to market growth, as traditional transmission fluids are less needed in these vehicles compared to internal combustion engine vehicles.

Regional Overview

Asia-Pacific leads the global transmission fluid market, commanding approximately 55% of the market share in 2024. The region’s dominance is driven by a robust automotive ecosystem in countries like China, India, Japan, and South Korea. Rapid industrialization, government emission regulations such as India’s Bharat Stage VI standards, and the widespread use of passenger and commercial vehicles fuel demand for high-performance transmission fluids. Additionally, the rise in off-road vehicles utilized in agriculture, mining, and construction supports market growth in the region.

North America is forecasted to be the fastest-growing region across the forecast period due to advanced manufacturing innovations and increasing awareness regarding vehicle maintenance. The adoption of Industry 4.0 technologies, including IoT-enabled real-time fluid performance monitoring, enhances the market potential. Government initiatives promoting fuel efficiency and stringent emission regulations, particularly in the United States, are accelerating the adoption of synthetic and eco-friendly transmission fluids.

Europe maintains a significant market share, supported by its mature automotive manufacturing industry focused on precision engineering and sustainability. Stringent regulations like the Euro 7 emission standards encourage manufacturers to produce advanced transmission fluids that meet high-quality and environmental benchmarks.

Market Segmentation

The market segments highlight automatic transmission fluids (ATFs) as the dominant product category due to the growing preference for automatic vehicles worldwide. ATFs are essential for smooth operation in passenger and commercial vehicles, contributing the largest revenue share. Synthetic base oils form the backbone of these fluids, appreciated for their superior thermal stability and longevity.

Passenger vehicles represent the largest application segment, with rising vehicle ownership and the prevalence of automatic transmissions driving fluid consumption. The aftermarket segment is also expanding, powered by increasing vehicle maintenance awareness and extended vehicle lifecycles, especially in emerging markets.

Challenges and Opportunities

While the increasing market penetration of electric vehicles restrains traditional transmission fluid demand, this also creates opportunities for specialized fluid formulations tailored to EVs and hybrids. Fluctuating crude oil prices continue to challenge the cost stability of mineral-based fluid production. However, strategic investments in R&D by major industry players to develop synthetic and eco-friendly fluids help offset these challenges.

The market also benefits from the growing aftermarket for vehicle maintenance, especially in emerging economies, where rising disposable incomes and vehicle fleets elevate the frequency of transmission fluid replacements. Innovations such as extended drain intervals and Industry 4.0 integration for fluid monitoring offer additional growth avenues.

Key Players and Competitive Landscape

Leading companies in the transmission fluid market emphasize innovation, sustainability, and strategic collaboration. The competitive environment features substantial investments in research to deliver high-performance, eco-friendly fluids compatible with evolving transmission technologies, including those for electric and hybrid vehicles. Industry giants focus on expanding aftermarket services, optimizing pricing strategies, and leveraging technological advancements to maintain market leadership.

This comprehensive outlook underscores the transmission fluid market’s robust growth prospects through 2033, driven by automotive industry expansion, technological progress, and a shift toward greener, high-performance fluid solutions. With Asia-Pacific at its core and North America accelerating rapidly, the market is well-positioned to adapt to emerging challenges and capitalize on new opportunities in a transforming mobility landscape.