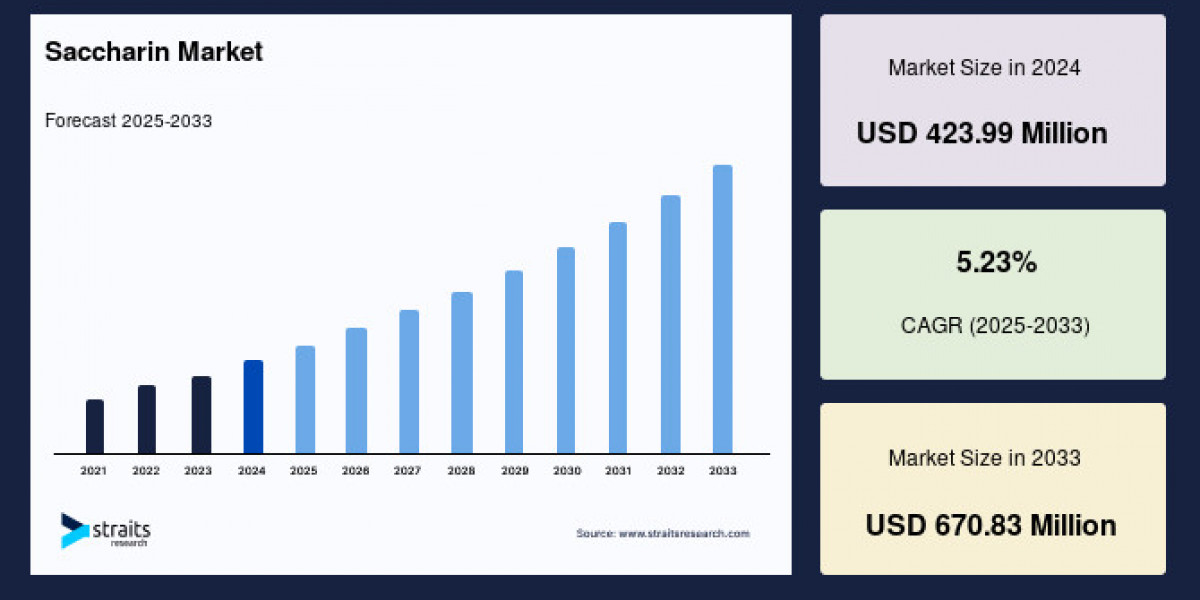

The global saccharin market size was valued at USD 423.99 million in 2024 and is estimated to grow from USD 446.17 million in 2025 to reach USD 670.83 million by 2033, growing at a CAGR of 5.23% during the forecast period (2025–2033).

Market Overview and Drivers

Saccharin is nearly 300 to 500 times sweeter than sucrose, requiring only minimal quantities to impart desired sweetness levels. This economic efficiency is especially valuable in large-scale, cost-sensitive industrial formulations. Its remarkable thermal and chemical stability enables it to maintain sweetness under extreme processing conditions, making it suitable for diverse applications in mass-produced soft drinks, confectionery, baked goods, and dairy products.

Increasing health consciousness among consumers has fueled demand for low-calorie and sugar-free alternatives, driven primarily by the rising incidence of lifestyle-related conditions such as obesity and diabetes. Saccharin’s zero-calorie content and potent sweetening power make it an ideal substitute in diet beverages, sugar-free foods, and pharmaceutical formulations aimed at managing weight and chronic illnesses.

Beyond food and beverages, saccharin finds valuable use in personal care products such as toothpaste and mouthwash, and in pharmaceutical syrups and chewables to mask bitterness. Industrial applications, including its function as a brightener in metal electroplating, add to its market diversity and resilience.

Regional Insights

North America remains the largest market for saccharin, supported by widespread consumer preference for calorie-free sweeteners and growing health awareness. In the United States, more than 37 million people living with diabetes drive steady demand for artificial sweeteners in processed foods and pharmaceuticals. Regulatory support from the U.S. FDA reinforces confidence in saccharin’s use, and leading beverage companies continue to incorporate it in diet sodas and low-calorie products.

The Asia Pacific region is the fastest-growing saccharin market. This growth is stimulated by rapid urbanization, rising middle-class income, changing dietary patterns favoring processed foods, and strong manufacturing bases. China dominates global saccharin production, accounting for over 80% of worldwide output, benefitting from low production costs and government support for exports. The expanding pharmaceutical and personal care sectors in Asia Pacific further propel saccharin demand.

In Europe, saccharin adoption grows in response to regulatory efforts targeting sugar intake reduction and public health improvement. Germany stands out due to its robust food and pharmaceutical industries, with major brands reformulating products to meet clean-label and low-sugar consumer preferences. Endorsement from the European Food Safety Authority (EFSA) helps mitigate skepticism about artificial sweeteners.

Product Segmentation and Industry Usage

Sodium saccharin dominates the market due to its superior solubility, intense sweetness, and wide applicability. It offers cost advantages over natural sweeteners and is favored in large-scale food and pharmaceutical manufacturing. Powdered saccharin, in particular, holds a significant share because of ease of handling, longer shelf life, and blending convenience required for precise dosing in food, beverage, and pharmaceutical sectors.

The food and beverages segment leads application demand, propelled by consumers’ increasing preference for sugar-free and low-calorie products. Saccharin is extensively utilized in soft drinks, baked goods, dairy products, and confectionery. Its heat stability allows manufacturers to reduce sugar content without compromising flavor quality.

Offline distribution channels currently dominate saccharin sales, especially through B2B buying by manufacturers, wholesalers, and specialty chemical suppliers. These traditional supply chains provide reliability and trust necessary to serve bulk and industrial customers. However, the rise of online retail platforms presents additional opportunities for reaching smaller buyers and expanding geographic penetration.

Market Challenges and Opportunities

Despite regulatory approval worldwide for safe consumption within recommended limits, saccharin faces persistent skepticism from some consumers regarding the safety of artificial sweeteners. Historical studies linking saccharin to health risks—even though refuted for human use—contribute to reluctance in certain markets. The growing consumer preference for natural sweeteners such as stevia poses competitive pressure.

Nonetheless, ongoing investments in research and development are reshaping the market by exploring saccharin’s potential therapeutic applications and improving product taste and stability. These innovations, combined with rising health awareness and expanding applications in personal care and pharmaceutical sectors, offer strong avenues for market growth.

Outlook

The saccharin market outlook remains positive, supported by its cost-effectiveness, multi-industry uses, and growing global demand for healthier sugar substitutes. The market is expected to maintain a steady CAGR of over 5% through 2033 driven by rising consumer health consciousness, expanding end-use applications, and regional growth dynamics, especially in Asia Pacific and North America.

Expansion strategies by major market players focus on increasing production capacities, enhancing product purity, and forging collaborations to penetrate emerging markets. Regulatory backing and consumer education will play critical roles in sustaining demand amid changing preferences and competitive alternatives.

In conclusion, saccharin is poised to continue its role as a key artificial sweetener worldwide, benefiting from its functional advantages and the global shift toward calorie-conscious consumption patterns.