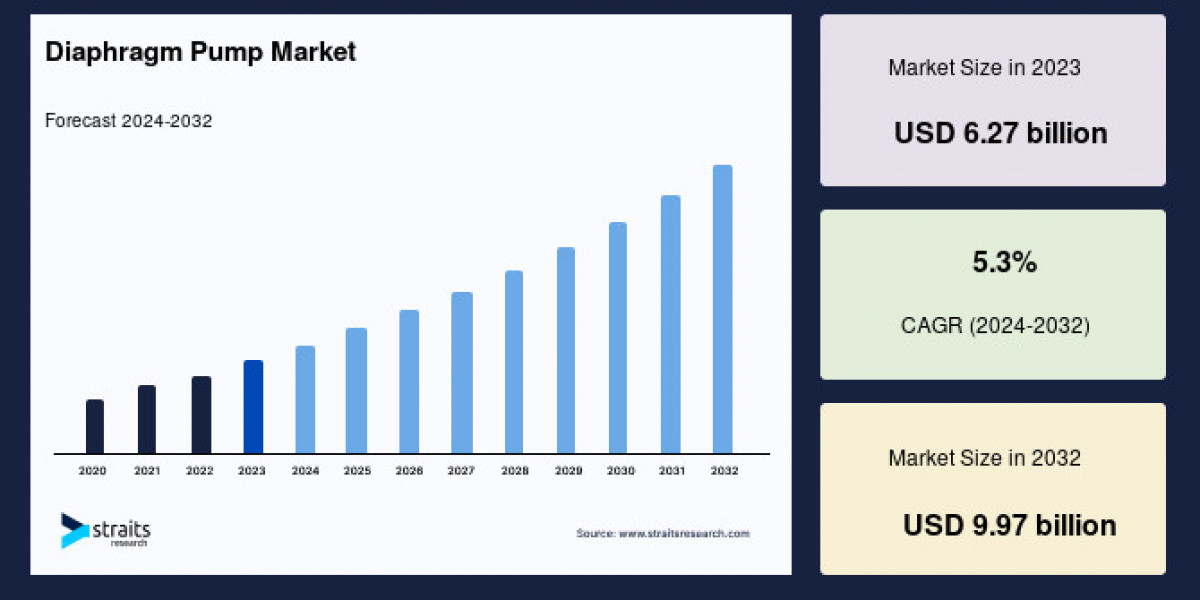

The global diaphragm pump market size was valued at USD 6.27 billion in 2023 and is estimated to reach from USD 6.60 billion in 2024 to USD 9.97 billion by 2032, growing at a CAGR of 5.3% during the forecast period (2024–2032).

What is a Diaphragm Pump?

A diaphragm pump is a type of positive displacement pump that transfers fluids by the reciprocating motion of a flexible diaphragm. This action alters the volume in the pump chamber and facilitates fluid movement. These pumps can be mechanically or pneumatically driven and are well-regarded for their ability to handle a variety of challenging fluids, including those with corrosive, abrasive, or viscous properties. They are self-priming, capable of dry running without damage, and do not require seals, which reduces leak risks and maintenance complexity.

Key Growth Drivers

The most prominent driver in the diaphragm pump market is the escalating demand for water and wastewater treatment. As global urbanization increases, so does pollution and the need for sustainable water management solutions. Governments worldwide are enforcing stringent regulations and investing heavily in water infrastructure projects to curb environmental degradation. Diaphragm pumps play a critical role in these treatment processes by efficiently handling sludge, slurry, and chemicals, contributing to cleaner water supplies.

In addition to water treatment, diaphragm pumps are vital in several industries such as chemicals, pharmaceuticals, food and beverage, and oil and gas. Their durability and efficiency make them indispensable in processes requiring precise fluid transfer and chemical resistance.

Regional Market Dynamics

Asia-Pacific is the largest and fastest-growing market for diaphragm pumps, benefitting from rapid industrialization, urban infrastructure investments, and expanding chemical and pharmaceutical sectors. Countries like China and India lead regional growth, supported by government initiatives aimed at enhancing water treatment capacities and promoting industrial development. China's emphasis on environmental protection has resulted in significant investments in wastewater infrastructure, while India’s focus on sanitation and urban transformation initiatives is boosting diaphragm pump demand.

North America also holds a significant market share, driven by stringent environmental standards and advanced industrial applications. The United States leads this region, with regulations such as the EPA’s water and wastewater treatment requirements pushing the adoption of technologically advanced pumps. Market leaders in North America continue to innovate with products integrating smart technologies for monitoring and efficiency improvements. Canada’s growing focus on sustainability and industrial development further supports regional market growth.

Product Segmentation and Applications

The diaphragm pump market is segmented by operation type, mechanism, pressure capacity, and end-use industry:

Operation: Double-acting diaphragm pumps dominate due to their high efficiency and ability to handle abrasive and corrosive fluids in demanding applications.

Mechanism: Air-operated diaphragm pumps (AODD) lead the market because of their versatility and safety in hazardous environments, where electrical pumps pose risks. Electrical-operated pumps are also gaining traction with the integration of energy-efficient technologies.

Pressure Range: The up to 80 bar segment is the largest, preferred for low-pressure applications such as water and wastewater treatment where gentle fluid handling is essential.

End Use: Water and wastewater treatment constitute the largest application sector, followed by oil and gas, chemicals, pharmaceuticals, and food and beverage industries.

Challenges and Opportunities

One of the major market restraints is the relatively high initial cost and maintenance requirements of diaphragm pumps, which may deter small and medium-sized enterprises. These pumps often need skilled technicians for maintenance, increasing operational costs. However, continuous technological advancements are addressing these challenges. The introduction of smart pumps with IoT capabilities enables real-time monitoring and predictive maintenance, reducing downtime and costs.

Material innovations, such as enhanced PTFE and elastomeric diaphragms, are expanding the chemical compatibility of these pumps, further broadening their industrial applications. Energy-efficient designs including variable frequency drives optimize pump performance and reduce energy consumption, contributing to market growth.

Outlook

The future of the diaphragm pump market looks promising with steady growth expected across all regions, particularly in Asia-Pacific and North America. Increasing environmental regulations, investments in water infrastructure, and expanding industrial activities will continue to drive demand. Manufacturers investing in R&D and innovative smart technologies are poised to gain competitive advantages, offering pumps that deliver higher efficiency, durability, and cost-effectiveness.

In summary, diaphragm pumps are vital components for fluid handling in various industrial sectors. Their growing adoption is a reflection of the global priorities towards sustainable water management, efficient production processes, and safe handling of complex fluids. Continuous innovation and expanding industrial demand will sustain the market's upward trajectory through 2032 and beyond.