Gold Individual Retirement Accounts (IRAs) have gained vital attention in recent years as a means for investors to diversify their retirement portfolios. As conventional funding vehicles like stocks and bonds face market volatility, many people are turning to gold and other valuable metals as a hedge in opposition to inflation and financial uncertainty. This text will discover what a Gold IRA is, how it really works, its benefits and dangers, and the steps to set one up.

What is a Gold IRA?

A Gold IRA is a type of self-directed Particular person Retirement Account that enables buyers to hold physical trusted gold ira investment 2024 and other precious metals as a part of their retirement financial savings. Not like conventional IRAs, which typically hold paper belongings like stocks, bonds, and mutual funds, Gold IRAs allow investors to include tangible belongings in their retirement portfolios. This could provide a level of safety and stability that paper property might not supply, especially during economic downturns.

How Does a Gold IRA Work?

Gold IRAs operate beneath the identical tax rules as conventional IRAs. Contributions to a Gold IRA could also be tax-deductible, relying on the investor's income and tax filing standing. The funds in a Gold IRA develop tax-deferred, which means that investors do not pay taxes on the earnings till they withdraw the funds in retirement.

To arrange a Gold IRA, traders must work with a custodian that makes a speciality of valuable metals. The custodian is chargeable for managing the account, ensuring compliance with IRS rules, and facilitating the acquisition and storage of the physical gold. Buyers can fund their Gold IRA by means of contributions, rollovers from existing retirement accounts, or transfers from other IRAs.

Varieties of Valuable Metals Allowed in a Gold IRA

Not all types of gold and valuable metals are eligible for inclusion in a Gold IRA. The IRS has particular pointers regarding the types of metals that may be held in these accounts. Typically, the next types of metals are permitted:

- Gold: Should be not less than 99.5% pure (e.g. If you have any sort of concerns concerning where and the best companies for ira precious metals investment ways to make use of best companies for ira gold investment, you can call us at the web page. , American Gold Eagles, Canadian Gold Maple Leafs, and gold bars from authorized refiners).

- Silver: Should be at the very least 99.9% pure (e.g., American Silver Eagles and Canadian Silver Maple Leafs).

- Platinum: Must be a minimum of 99.95% pure.

- Palladium: Should be at the very least 99.95% pure.

Advantages of a Gold IRA

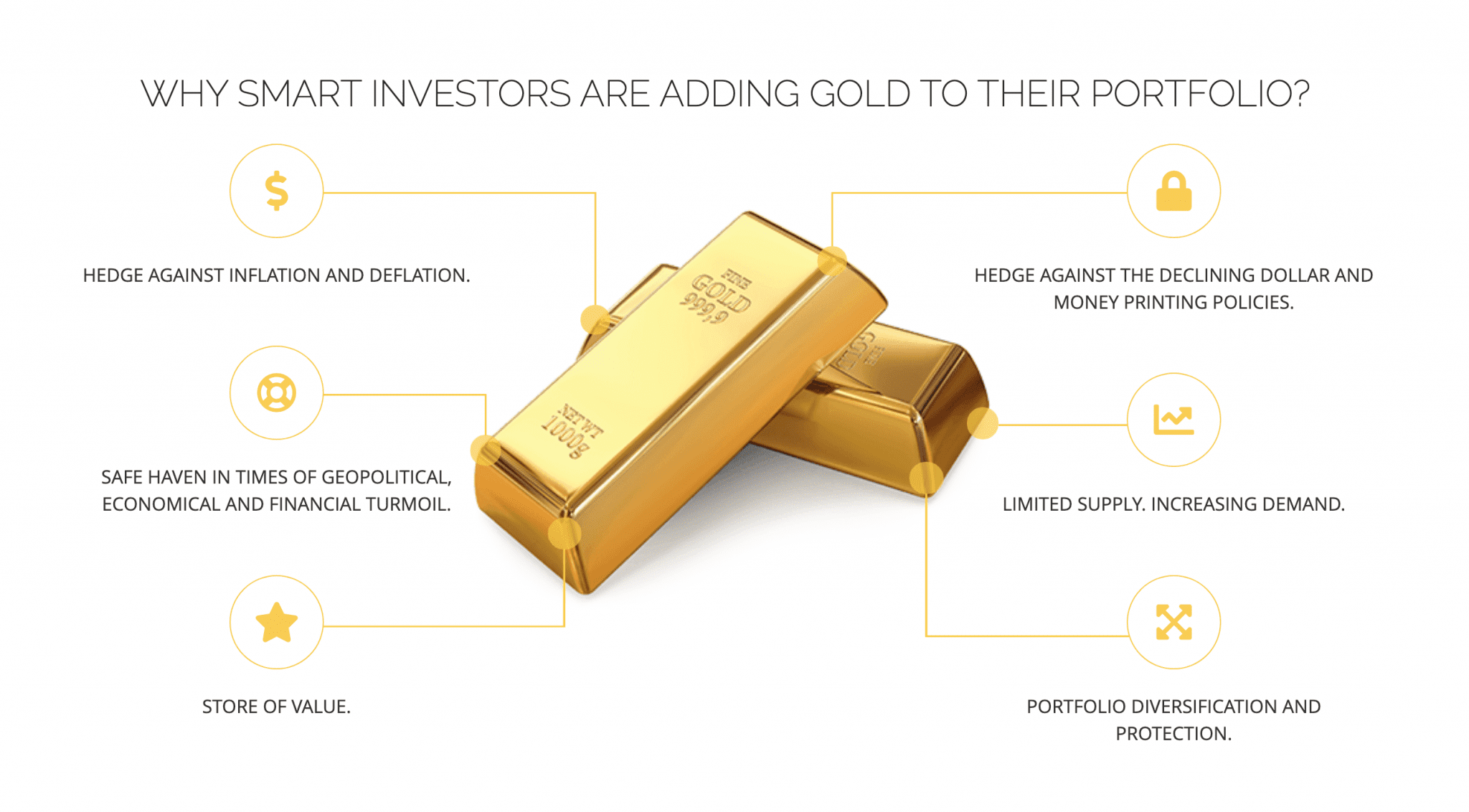

- Diversification: A Gold IRA permits investors to diversify their portfolios beyond conventional assets, doubtlessly lowering danger and enhancing returns.

- Inflation Hedge: Gold has traditionally been considered as a hedge in opposition to inflation. As the value of paper foreign money declines, the worth of gold usually increases, providing a safeguard for retirement financial savings.

- Tangible Asset: In contrast to stocks and bonds, gold is a bodily asset that buyers can hold. This tangible nature can provide peace of thoughts, particularly throughout periods of financial instability.

- Lengthy-Time period Development Potential: Gold has demonstrated lengthy-time period value retention and appreciation, making it a lovely option for retirement savings.

- Tax Advantages: Like conventional IRAs, Gold IRAs offer tax-deferred progress, allowing buyers to postpone taxes on earnings till withdrawal.

Risks of a Gold IRA

- Market Volatility: While gold is commonly seen as a stable funding, its price can be risky in the quick time period. Investors must be ready for fluctuations in value.

- Storage and Insurance coverage Prices: Physical gold should be stored in a safe location, which may incur storage fees. Moreover, traders may have to purchase insurance coverage to guard their funding.

- Limited Liquidity: Promoting physical gold can take time, and buyers could not be able to access their funds as shortly as they could with conventional investments.

- Regulatory Compliance: Gold IRAs must adhere to IRS regulations, and any missteps can result in penalties or disqualification of the account.

Steps to Arrange a Gold IRA

- Select a Custodian: Research and select a custodian that focuses on Gold IRAs. Guarantee they are respected and have a track file of compliance with IRS regulations.

- Open an Account: Full the required paperwork to open a Gold IRA account with your chosen custodian. This may occasionally embrace providing private data and monetary particulars.

- Fund the Account: You can fund your Gold IRA by way of direct contributions, rollovers from present retirement accounts, or transfers from different IRAs. Be sure to comply with IRS pointers for rollovers to keep away from penalties.

- Choose Your Precious Metals: Work together with your custodian to choose the gold and other treasured metals you would like to include in your IRA. Be sure that they meet IRS purity requirements.

- Storage: The custodian will arrange for the safe storage of your physical gold in an authorized depository. You will not have the ability to take possession of the gold whereas it is in your IRA.

- Monitor Your Funding: Often overview your Gold IRA and keep informed about market trends and economic conditions that will influence the value of your funding.

Conclusion

A Gold IRA is usually a beneficial addition to a diversified retirement portfolio, offering investors the chance to hedge in opposition to inflation and financial uncertainty. Whereas there are risks associated with investing in gold, the potential benefits make it a pretty possibility for many people looking to safe their financial future. As with every investment, it is essential to conduct thorough research and consult with financial advisors to find out if a Gold IRA aligns with your retirement objectives and danger tolerance. By understanding the ins and outs of Gold IRAs, traders could make informed selections that may help them obtain their lengthy-time period monetary aims.