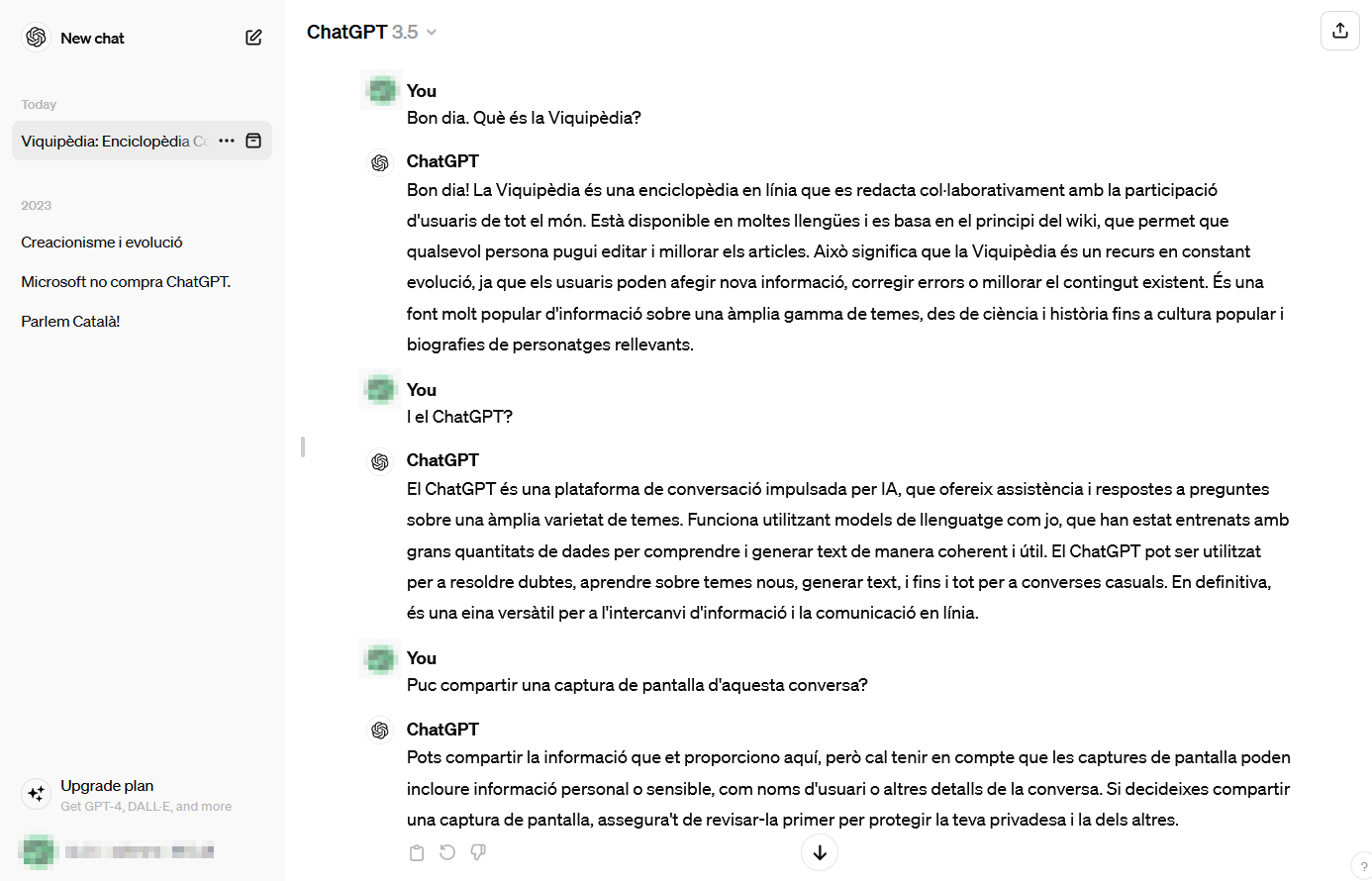

In recent years, the allure of gold as a safe-haven asset has gained traction among investors, especially these looking to secure their retirement financial savings. A Gold Particular person Retirement Account (IRA) permits people to put money into physical gold and different treasured metals as a part of their retirement portfolio. This text delves into what a Gold IRA kit is, how it really works, its benefits, and what you want to contemplate when investing in a single.

What's a Gold IRA Kit?

A Gold IRA kit is a comprehensive package provided by many monetary institutions and firms that specialize in treasured metals. It typically contains all the required info and instruments to help traders arrange a Gold IRA, together with instructional materials, guides on how you can switch funds from existing retirement plans with gold-backed ira accounts, and particulars in regards to the kinds of gold and different metals that may be included in the IRA.

The kit might also provide data on the IRS rules governing Gold IRAs, which is essential for making certain compliance. Moreover, it typically comprises an inventory of accepted custodians who will manage the IRA, in addition to recommendations reliable companies for gold ira investment reputable dealers from whom to buy the gold.

How Does a Gold IRA Work?

A Gold IRA features similarly to a traditional IRA, with the important thing distinction being that it allows for the investment in bodily valuable metals. Here’s a step-by-step overview of how it really works:

- Choose a Custodian: The IRS requires that all IRAs be held by a qualified custodian. This can be a monetary establishment that is authorized to hold and handle retirement accounts. When you purchase a Gold IRA kit, you’ll typically discover an inventory of really helpful custodians.

- Open Your Account: Once you’ve chosen a custodian, you’ll must open an account. This process often entails filling out forms and providing identification and financial information.

- Fund Your Account: You can fund your Gold IRA through numerous means, equivalent to rolling over funds from an present retirement account (like a 401(ok) or conventional IRA) or making a direct contribution. The Gold IRA kit will present guidance on how to do this.

- Purchase Gold and Other Precious Metals: After funding your account, you may begin purchasing gold and different accredited metals. The equipment will present an inventory of eligible merchandise, which typically embody American Gold Eagles, Canadian Gold Maple Leafs, and other authorities-minted coins and bars.

- Storage: Bodily gold have to be saved in a secure, IRS-authorized depository. The custodian will usually coordinate the storage of your metals, making certain they are safe and compliant with IRS regulations.

- Monitoring Your Investment: As soon as your Gold IRA is established and funded, it’s important to observe your investments. Many custodians provide online entry to your account, permitting you to track the efficiency of your gold and different property.

Benefits of a Gold IRA

Investing in a Gold IRA comes with a number of advantages:

- Hedge In opposition to Inflation: Gold has historically been seen as a hedge towards inflation. When the value of fiat currencies declines, gold usually retains its value and even appreciates, making it a priceless asset for preserving buying power.

- Diversification: Including gold to your retirement portfolio can enhance diversification. A diversified portfolio may help mitigate risks associated with market volatility, as gold usually strikes independently of stocks and bonds.

- Tax Benefits: Like traditional IRAs, Gold IRAs provide tax-deferred progress. This means that you just won’t pay taxes on the positive aspects out of your gold investments till you withdraw funds from the account throughout retirement.

- Physical Asset: Unlike stocks and bonds, gold is a tangible asset. Many traders discover comfort in holding a bodily commodity that has intrinsic value, particularly during economic uncertainty.

- Wealth Preservation: Gold has been a retailer of worth for thousands of years. By including it in your retirement plan, you’re investing in a time-examined asset that has survived economic downturns and foreign money fluctuations.

Issues When Investing in a Gold IRA

Whereas a Gold IRA can be a beneficial addition to your retirement technique, there are vital factors to think about:

- Prices and Charges: Setting up a Gold IRA usually entails various fees, including setup fees, storage fees, and transaction charges when buying or selling metals. It’s essential to know these costs and the way they may impact your investment returns.

- IRS Laws: The inner Income Service has specific laws relating to what kinds of metals might be included in a Gold IRA. Not all gold products are eligible, so it’s important to make sure that your investments adjust to IRS pointers.

- Market Volatility: While gold is usually seen as a secure investment, it is not immune to market fluctuations. The value of gold may be unstable, and traders needs to be ready for potential price swings.

- Liquidity: Bodily gold is less liquid than different investments like stocks or bonds. Promoting gold could take time and could contain extra prices, so it’s essential to think about your liquidity wants.

- Analysis and Training: Before investing in a Gold IRA, thorough analysis is important. Utilizing the academic sources provided in a Gold IRA kit can enable you to make informed choices about your investments.

Conclusion

A Gold IRA kit generally is a beneficial software for investors looking to diversify their retirement portfolios with valuable metals. In the event you loved this information and you would like to receive more info with regards to Best Gold ira For investment please visit the page. By understanding how a Gold IRA works, its advantages, and the issues concerned, you can also make knowledgeable selections that align along with your monetary targets. As all the time, consulting with a monetary advisor earlier than making vital funding selections is advisable to make sure that your retirement technique is sound and tailored to your individual wants. By taking these steps, you possibly can safeguard your retirement financial savings and doubtlessly improve your monetary future with the timeless value of gold.